Our mission is to

end the double taxation of Americans abroad.

TFFAA welcomes Rep. LaHood’s historic

Residence-Based Taxation for Americans Abroad Act

and Sen. Todd Young’s support

Who supports us — Americans abroad

What we want

Millions of Americans abroad are already subject to taxation where they live. They shouldn’t also be taxed on non-U.S. income or face financial exclusion and unfair and disproportionate penalties for maintaining bank accounts in the countries where they live just because they are American.

Help us end U.S. Double Taxation and all the financial discrimination, high costs and hassles it imposes on Americans living abroad!

Try out our exclusive RBT Savings Calculator

You're just a few clicks away from discovering how much you could have saved if you weren’t taxed twice.

Donate

We believe that it's time to take a stand and fight to end double taxation once and for all. Your support brings us closer to achieving a more just and reasonable tax system for Americans abroad.

Join the fight

We’re a team of people who are passionate about tax justice. We have demonstrated our spirit and our skill in driving change. We need all the support we can get. Please help us!

Latest testimonials from our blog

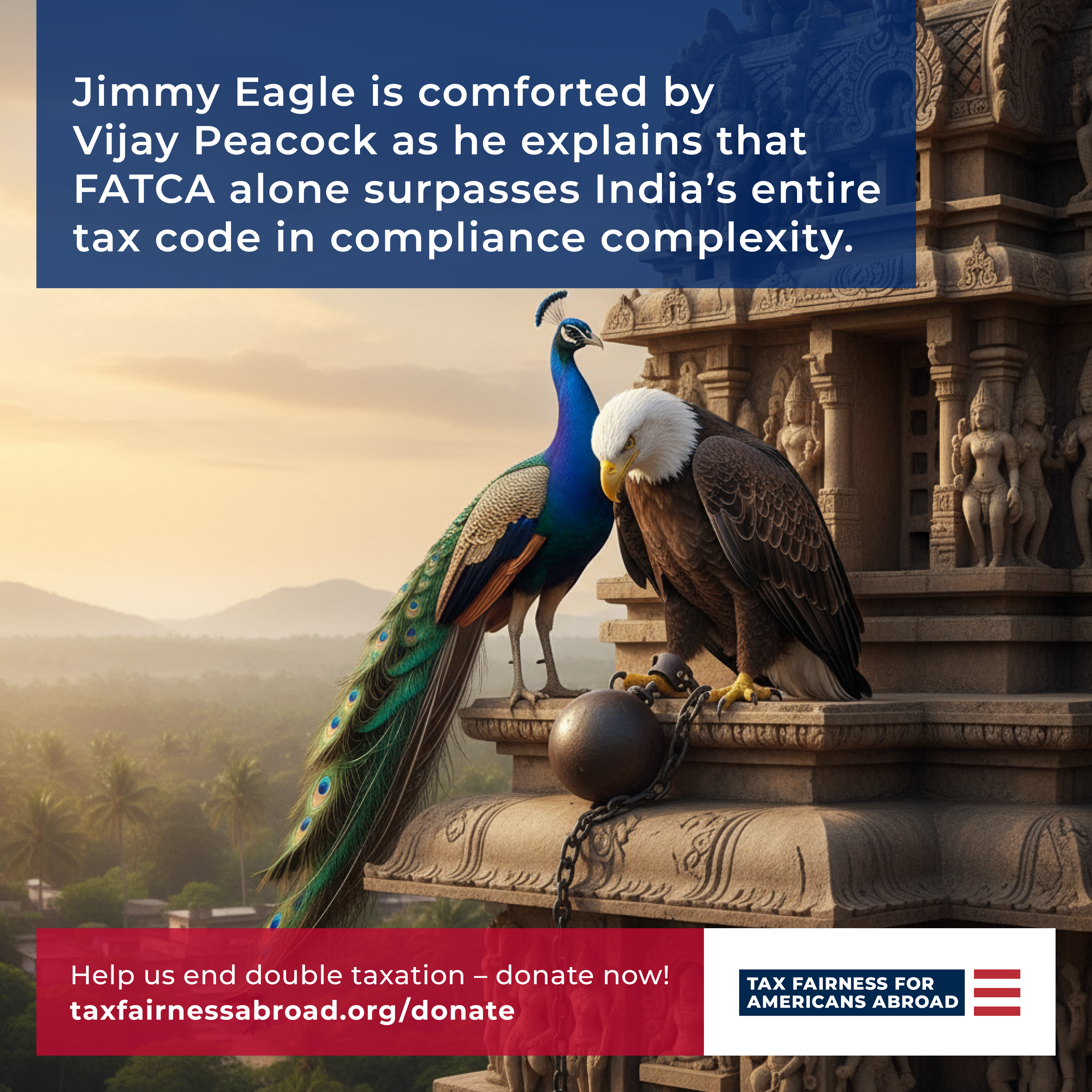

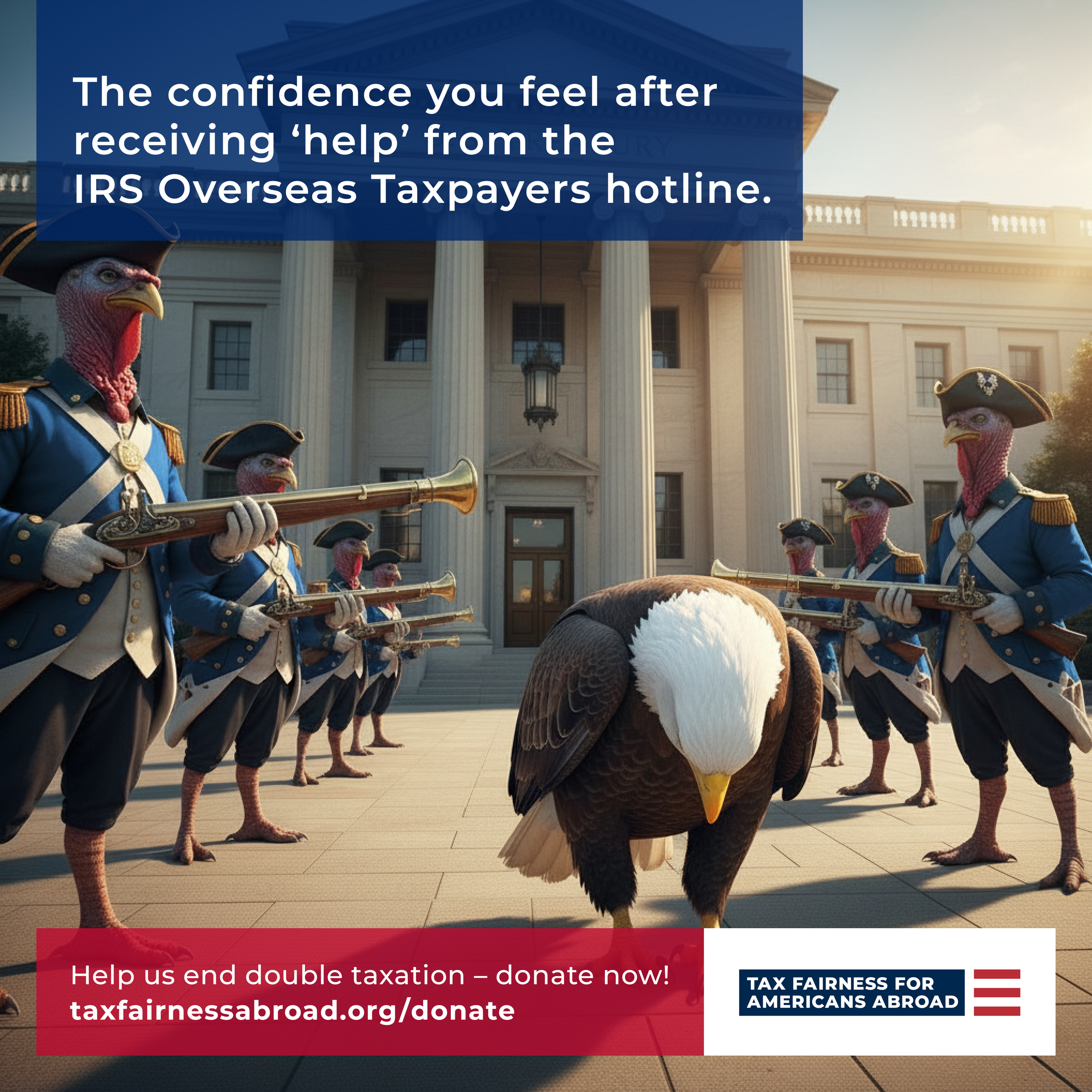

Team Eagle’s satirical take on citizenship-based taxation

Why join the fight?

Double Taxation: One of our main concerns is the potential for discriminatory double taxation. Under Citizenship-Based Taxation (CBT), individuals may be subject to taxation on their worldwide income in both their country of residence and in the United States. This double taxation restricts Americans’ freedom and pursuit of happiness and can lead to significant financial burdens.

Complexity and Discrimination: Double taxation can be highly complex and burdensome for Americans living abroad. It requires them to navigate both the U.S. tax code and that of the country where they live. That often means higher compliance costs. Moreover, many foreign financial institutions actively discriminate against Americans, denying them basic banking and financial services, because of uniquely American compliance requirements.