Double taxation and de-banking make a proud American begin to rue his U.S. citizenship

Double taxation and de-banking make a proud American living in France begin to rue his U.S. citizenship.

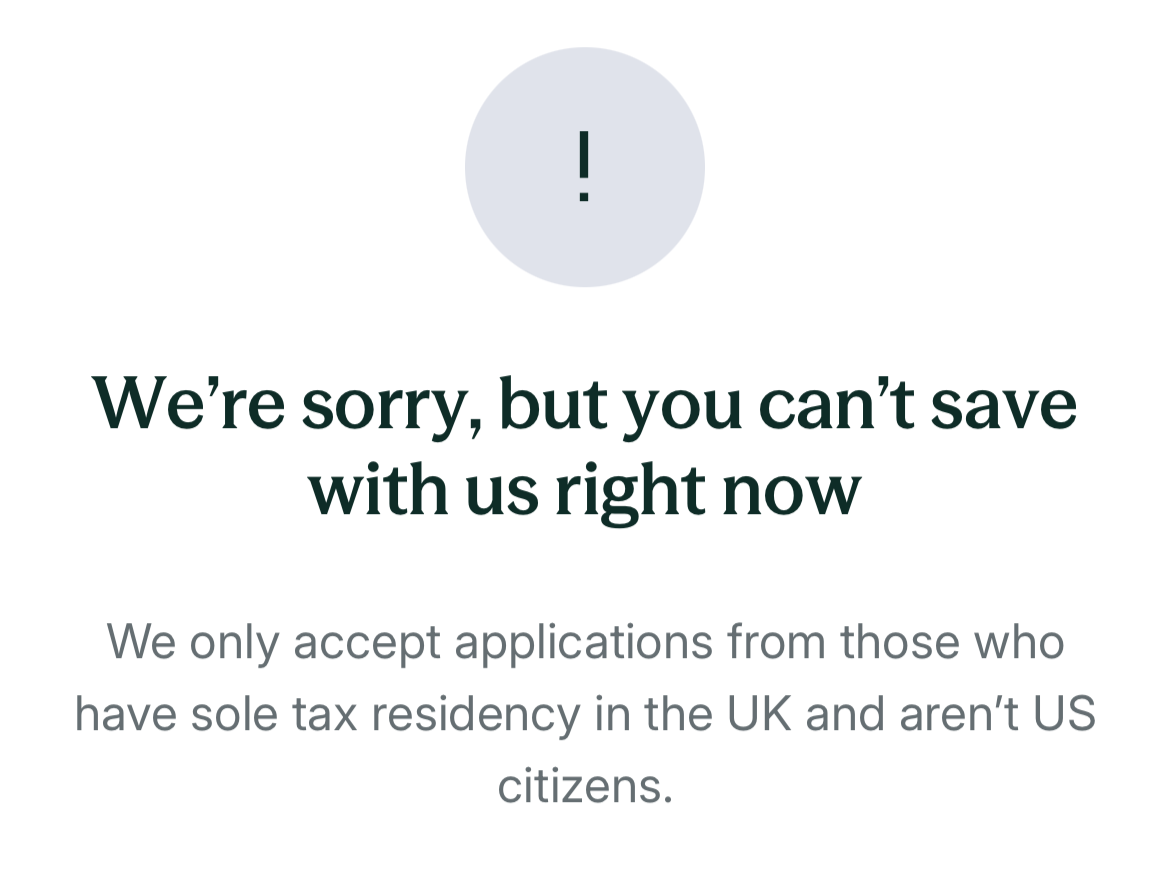

An American in the UK is dismayed by the threat of de-banking

Julia, an American living in the United Kingdom, is dismayed by the threat of de-banking—just because she’s American.

The hidden burden of being an American abroad

An American caring for an elderly relative suffers from the hidden burdens of being an American abroad.